I continue to try to educate the world that the typical, pre-tax, employer-sponsored 401K sucks! On January 27, 2022, I wrote Blog #41 – Why Is It So Hard To Retire and showed how retirement via a 401K portfolio doesn’t work for 92% of investors. Did Americans stop investing through 401Ks? No. Ergo, I will take a different approach to expose just how bad 401Ks really are.

What are the two big selling points for the 401K? The company match, also known as other peoples’ money (OPM), and the tax savings. Therefore, I will focus only on these two things and, once again, put some numbers behind my rantings. Let’s look at two very different investors, Joe Conventional and Susie Alternative.

Joe Conventional

Joe Conventional is a highly paid executive, and his most recent, annual salary and bonuses totaled $500K. Joe’s employer offers the typical pre-tax 401K plan, which allows him to only invest in a limited number of mutual funds and matches his contributions fifty cents on the dollar up to six percent of Joe’s pay.

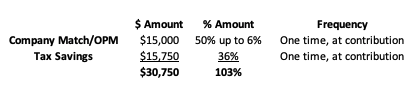

Joe followed the conventional wisdom espoused to him by his financial advisor that he at least needed to contribute six percent of his pay, enough to get the maximum matching money. After all, it’s free money. So, Joe dutifully contributes six percent of his income, $30K ($500K x 6% = $30K), and the company contributes an additional $15K ($30K x 50%), which gives Joe a total contribution of $45K for that calendar year.

Joe is in the 35% tax bracket, so the $45K contributions to his account will be not taxed, saving him $15,750 in taxes ($45K x 35% = $15,750). The total value of the company match/OPM and tax benefits are $30,750 or 103% of Joe’s $30K contribution ($30,750/$30K = 103%). Keep in mind, Joe only gets the company match and tax savings once, at the time he contributes.

Susie Alternative

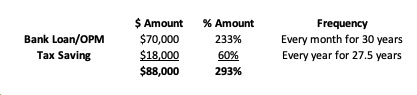

Susie Alternative earns $100K per year. While Susie’s employer offers the same pre-tax 401K plan as Joe’s company, she has read Get off You A$$ and Manage Your Money: Why You Need Alternative Investments and chooses not to get onto the 401K highway to mediocrity. Since Susie’s income is more modest, she knows she must get better returns on her investment (ROI) to get to financial freedom faster. Ergo, Susie takes $30K she has saved and uses it as a down payment on a $100K single-family rental (SFR) and finances the balance with a $70K bank loan. In the case of the 401K, the OPM came in the form of a company match from Joe’s employer. The SFR comes with OPM, too, in the form of the $70K bank loan. What’s even better is that Susie’s tenants will pay off the $70K principal in addition to interest, taxes, and insurance for the next thirty years.

But wait, there’s more! When you own an SFR, the Internal Revenue Service lets you deduct from your income the value of the building only (the value of the building might be 75% and the land 25%, for example) over 27.5 years in the form of depreciation. On Susie’s $100K SFR, she’ll be able to deduct 75% of $100K, or $75K over the next 27.5 years. Assuming she’s in a 24% tax bracket, Susie will save $18K in taxes over the next 27.5 years ($100K x 75% x 24% = $18K). The total value of the bank loan/OPM and tax benefits are $88K or 293% of Susie’s $30K contribution ($88K/$30K = 293%).

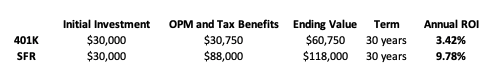

Of course, it’s unlikely that these investments won’t appreciate over time or that the SFR won’t generate positive cash flow. Additionally, most investors will likely make more than one contribution to their 401K and purchase more than one SFR. But, again, I’m just comparing the value of the OPM and tax benefits (the two main selling points of the 401K) associated with each $30K investment

30-Year Annualized Return -401K vs. SFR

Regardless of whether you’re a conventional investor or alternative investor, you’re not likely to make only one contribution to your 401K or buy only one SFR. But what if you did? What would the performance of each of these investments look like over thirty years based on just the OPM and tax savings? The $30,750 value of the 401K’s company match/OPM and tax benefits translate into a 3.42% annualized return on investment. The $88K value of the SFR bank loan/OPM and tax savings translate into a 9.78% annualized return on investment.

As I mentioned at the beginning of this article, the big selling points of 401Ks are the company match and the tax savings. But, as I’ve just shown, these two benefits are inferior to the similar benefits you get from an SFR. The OPM and tax benefits of an SFR are almost three times more valuable than that of the 401K! So all of you who are investing through a 401K and aren’t getting to financial freedom or retirement as fast as you’d like, now you know why; your 401K sucks! It’s an inferior investment on its two biggest selling points, not to mention:

- Your distributions will be taxed as ordinary income instead of long-term capital gains (ordinary income being taxed higher).

- You’re limited to investing in mutual funds

You’re on what I like to call the 401K highway to mediocrity.

I wish I had $100 every time someone spouted the conventional wisdom: “You at least need to contribute the amount to your 401K that gets you the company match; it’s a no-brainer.” But, I think I’ve just shown it’s just the opposite; the no-brainer is to STOP contributing to your 401K and invest in real estate or some other alternative where the OPM and tax benefits are almost three times as valuable.

I know many of you do not want to invest in real estate. It’s unfamiliar, scary, and it will undoubtedly be more work than direct-depositing money into a 401K. I get it, but the rewards of the extra work are tremendous. And, there are some easier ways to invest in real estate that don’t involve you being a landlord and the first person to get a phone call when a toilet needs fixing. If you’re an accredited investor, you’ve got it made as many options are available to you. As an accredited investor, my favorite way to invest in real estate is via syndications. My favorite apartment syndicator is Western Wealth Capital. If you’re not an accredited investor, I suggest you consider acquiring SFRs or up to fourplexes using a turn-key provider. There are many of these across the country, and while I have not used any of them, two that seem to have excellent reputations are:

The Hybrid Option – The In-Service Transfer

I know some of you still aren’t convinced, so there is a 401K hybrid option, the in-service transfer. An in-service transfer is when your 401K plan allows you to take a distribution from your 401K and transfer money into a self-directed IRA or 401K. From this new IRA or 401K, you can use that money to invest in alternative investments, like putting a down payment on an SFR as Susie Alternative did in the example above. Via this method, you will benefit from the 401K match and the bank loan/OPM associated with the SFR. Keep in mind, you lose the tax benefits when you invest in real estate from an IRA of 401K, but if that’s the only money you have to get started in real estate, just get started. Not all plans allow for an in-service transfer, and if your plan does, it will have terms and conditions you’ll need to review carefully to see if this option makes sense for you. See Blog #3- You Don’t Have Any Money To Invest? Can You Withdraw Some Of Your 401K Money Now, where I discuss the in-service transfer I discovered and took advantage of many years ago.

Now that I’ve given you some new and compelling information, what are you going to do? You can continue down the inferior 401K path with the masses, work until your sixty-five, and live like a pauper in retirement. Alternatively, you can take the road less traveled, get off your A$$ and move into an alternative investment like an SFR where you will reach retirement or financial freedom sooner, live like a king in retirement, and do great things for your family and the world. The choice is yours.

As I mentioned in Blog #41 – Why Is It So Hard to Retire, the 401K only works for 8% of the population, the 8% who have a multi-million dollar 401K. It will probably work for Joe Conventional with his high income. So, if you’re like Joe and fit into this category, feel free to continue what you’re doing. If, however, you’re part of the 92% like me and Susie Alternative that do not and are not likely ever to have a multi-million dollar 401K, I suggest you read this article and Blog #41 and think hard about the type of future you want for yourself and your family.

Help Me Break The Stranglehold Conventional Investing Wisdom Has On Most Investors

- Educate yourself; buy the book. Get off Your A$$ and Manage Your Money: Why You Need Alternative Investments is a great way to get an overall view of alternative investments and why they are vastly superior to conventional investments. You can order the book here.

- Gift the book to young people in your life. They have a long investing runway ahead of them, and the sooner they choose the alternative path, the better off they will be.

- Leave a Google review. If you like the content here at TheProlificInvestor.net, Google reviews are one way I can grow my brand and help more people make better financial decisions. To leave a Google review, click here.