Of all the writing I’ve done over the past years, I’ve never written an article comparing three common ways to invest in real estate. Of course, I’ve talked about it many times in interviews, but I’ve never laid it out in an article with my usual visual aids, so here goes!

What I’m about to discuss certainly doesn’t represent the only way to invest in real estate. Still, it represents three common ways readily available to most people. I’ve done two of the three, single-family rental do It yourself (SFR DIY) and apartment syndications. If I knew way back then what I know now, I would have skipped the SFR DIY and gone directly to SFR turnkey or apartment syndications. Today I primarily invest in apartment syndications.

SFR Do It Yourself

With this method, you’re going to purchase an SFR near you, and you’ll be doing everything:

- Pick the market

- Find a realtor

- Select the property

- Obtain financing

- Advertise

- Screen tenants

- Manage the property

- Perform repairs or manage vendors

- Collect rent

- Pay all expenses

You are the jack of all trades, and you essentially own a small business; you now have a second job assuming you already have a full-time one. Assuming this is a $200K SFR, your down payment will be around $50K, and your return on investment (ROI) will be approximately 15% before tax benefits. That’s a good ROI, but keep in mind that it doesn’t take into consideration all the hours you’ll be spending running this small business in your free time. I based these numbers on an SFR for sale at the time of this writing.

SFR Turnkey

With this method, you’re going to purchase a $200K SFR somewhere in the country from a turnkey provider, and they will do a bunch of the work. Your responsibilities will be less but so will your returns:

- Pick the turnkey provider

- Select the property

- Obtain financing

- Manage the property manager

In this scenario, your responsibilities have gone from ten tasks down to four. Your most important job is to pick a great, highly recommended SFR turnkey operator with a track record of success, and they will do most of the work for you. Of course, you’ll have to pay them to take all this work off your hands, but that will give you a lot of your time back. You’ll still have a down payment of around $50K, but your ROI will shrink from 15% to 11% because you’re paying the turnkey provider to manage the property. I based these numbers on an SFR for sale at the time of this writing.

Apartment Syndication

Firstly, I need to define syndication. A syndication is when a group of people pools their money to buy an asset, in this case, an apartment building, that they would not be able to purchase on their own. A syndication usually comprises general partners who run the business, the business of buying and operating the apartment building; and the limited partners who put up the money, usually the down payment and money for repairs and improvements. Sometimes, the general partners also invest alongside the limited partners. The general and limited partners then share the profits and tax benefits of owning and operating the apartment building.

With this method, as a limited partner, you’ll be part-owner of an apartment building. Your responsibilities will be:

- Select the syndicator

- Select the property/market

In this scenario, your main task is to select a great syndicator who comes highly recommended and has a track record of success. If the syndication has multiple properties in multiple markets, you’ll need to select the property and market. Beyond that, you simply wire the money. This type of investment can be made with as little as $50K, sometimes lower. My favorite syndicator has a $25K minimum. I have never had an ROI of less than 20% with these types of investments. My favorite syndicator has a track record of delivering an average ROI of 30% across all their sold properties.

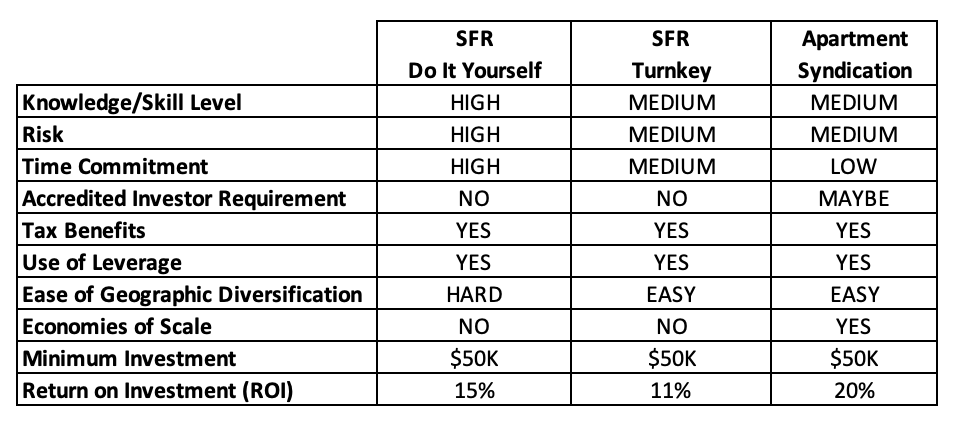

So far, I’ve primarily discussed your efforts associated with each investment, the minimum investment, and the ROI. In the chart below, I’ve compared each investment across ten categories.

Knowledge/Skill

- With an SFR DIY, you need the highest knowledge and skill level. With this method, you’ve essentially started a small business, and you’re doing everything yourself.

- With an SFR turnkey, you need medium knowledge and skill. You’re subcontracting a lot of the work to the turnkey operator whose business expertise is SFRs.

- With an apartment syndicator, you also need medium knowledge and skill. You’re passing all the work to the syndicator whose business expertise is apartment buildings.

Risk

- Every investment has some element of risk. If you don’t get the proper education and training before acquiring your first SFR DIY, your chance of failure is high. Again, you’re starting a small business. It is often said that fifty percent of new companies fail in the first year. I think your chances of complete failure are less than this, but starting a small business is not something to take lightly, especially if you already have a full-time job and a family with whom you like to spend time.

- With an SFR turnkey operator, you’re selecting a business to operate and manage the SFR you purchased. I classify the risk as medium. The biggest risk here is that you choose a bad operator. This can be mitigated by only selecting an operator who has a good track record and comes highly recommended by people you know, like, and trust.

- With an apartment syndicator, you’re selecting a business to operate and manage the apartment you collectively purchase with others. I classify the risk as medium. As with the SFR turnkey, choosing a bad operator is your biggest risk. This can be mitigated by only selecting a syndicator who has a good track record and comes highly recommended by people you know, like, and trust.

Time Commitment

- With an SFR DIY, you’ve just given away a bunch of your free time to run this small business.

- With an SFR turkey, you’re mostly hands-off but not completely. You will still have to oversee the property manager, review your investment’s performance, and make changes as necessary.

- With an apartment syndication, once you’ve wired off your money, you have no control or involvement whatsoever in the performance of your investment.

Accredited Investor Requirement

- To be an accredited investor, you must have an annual income exceeding $200K ($300K for joint income) or a net worth exceeding $1M, excluding your primary residence.

- There is no requirement to be an accredited investor with an SFR DIY and SFR turnkey.

- In my experience, most apartment syndicators require you to be an accredited investor. However, if you are not accredited and want to invest in a syndication, you need to find a syndicator that accepts non-accredited investors. *

Tax Benefits

- One of the great things about investing in real estate is that it comes with a built-in tax advantage called depreciation.

- With an SFR DIY and SFR turnkey, you will be able to claim depreciation on your tax return.

- With an apartment syndication, whether you receive your share of the depreciation depends on how the deal is structured. This would be one of the questions you need to ask the syndicator. I have not seen a syndication where the limited partners did not receive their pro rata share of depreciation, but I have heard that such deals exist.

Use of Leverage

- One of the benefits of investing in real estate and other alternative investments is that banks will loan you money to purchase real estate, unlike stocks, bonds, and mutual funds.

- With both SFR DIY and SFR turnkey, banks will loan you money to purchase properties.

- With an apartment syndication, while you won’t be obtaining the loan yourself, the apartment syndicator will; and you and the other limited partners benefit from the loan just as if you had obtained it yourself.

Ease of Geographic Diversification

- With an SFR DIY, it will be hard to invest in a market in a neighboring state or on the other side of the country, even though this might be the most profitable place to invest. You’ll have to assemble a team in that location to help you acquire and manage your rental property.

- With an SFR turnkey, it will be easy to invest in a neighboring state or on the other side of the country. These turnkey operators specialize in acquiring and operating good SFRs in solid, cash-flowing markets. All you have to do is pick a good one.

- With an apartment syndication, it’s easy to invest in an area other than where you live. Apartment syndicators will be focusing on markets where people and jobs are flowing; ergo, demand for rental housing is high. Again, all you have to do is pick a good one.

Economies of Scale

- With both an SFR DIY and SFR turnkey, you typically acquire one property and one tenant at a time. If you have one SFR, and it is vacant, you have 100% vacancy. If you own ten SFRs and have one empty, your portfolio is only 10% vacant. The problem is that it takes time to acquire ten or one hundred units and gain economies of scale.

- With an apartment syndication, you instantly gain economies of scale by acquiring partial ownership of a large apartment with a single investment.

Minimum Investment

- I purposely picked examples where the minimum investment is $50K. This amount is the actual down payment for an SFR for sale at this writing. Fifty thousand is also the lowest minimum investment requirement for most apartment syndicators. However, you can undoubtedly find SFRs in the U.S. for less than $200K thus requiring a down payment of less than $50K. Likewise, you will find a few apartment syndicators with minimums below $50k.

Return on Investment

- The ROI on the SFR I used for these examples is 15% annually.

- The ROI on the SFR turnkey I used for these examples is 11% annually.

- The 20% ROI I used for apartment syndications is based on my investing experience. I’ve never received an ROI less than 20% with my apartment syndications. At the time of this writing, the apartment syndicator I mainly use has returned an average annual ROI of 30% to investors since its inception in 2014.

If you’ve followed any of my work, you know my favorite investment is real estate, primarily apartments. The reasons are:

- Higher returns

- Built-in tax benefits of depreciation

- Control (the syndicator has it)

- The ability to use leverage

- Insurability

- Cash flow

My favorite way to invest in apartments is through syndications. The reason is that I want to make the most money and spend the least amount of my time in the process, and syndications allow me to do this.

Here’s an example of the performance of one of my apartment syndications. In October 2018, I invested $40K in a 200-unit apartment building in Atlanta, Georgia. This apartment was affected more than others in my portfolio by COVID, higher-than-expected maintenance costs, rising insurance premiums, and increasing property taxes. Despite these problems, we sold the property in February of 2022, and I received a check for $73,692, an average annual return of 25%. What did I do to almost double my money in less than four years? I picked a great syndicator, selected the market and property, and wired the money. And, because of depreciation, the $33,692 extra dollars that came back to me ($73,692 – $40,000 = $33,692) were tax free.

Are you on track for financial freedom or retirement? Are your investments earning you a tax-free annual return of 20% or more? If not, why aren’t you looking at real estate? I’ve given you three ways to do it, ranging from the time-consuming SFR DIY method to the comparatively passive apartment syndication. The choice is yours. You can stay on the 401K highway to mediocrity or break from the pack and invest like the rich, so someday you can join their ranks.

Resources

* One way to find syndicators and, more specifically, ones that accept non-accredited investors is to utilize Left Field Investors (LFI). Left Field Investors is “…a community of like-minded individuals interested in creating financial freedom through passively investing in real assets that generate real cash flow.” On LFI’s website, you can find a syndicator list. From this list, you can determine which ones accept non-accredited investors. Beyond that, LFI also has a paid membership program called Infielders. You can become a member of Infielders for $199 for the first year and $15 per month after that. With an Infielders membership, you’ll have access to a syndicator/sponsor summary, where the syndicators who accept non-accredited investors have already been identified for you as well as a side-by-side comparison of syndicators across many categories. I am an LFI Infielder but receive no compensation for recommending them.

Help Me Break The Stranglehold Conventional Investing Wisdom Has On Most Investors

- Educate yourself; buy the book. Get off Your A$$ and Manage Your Money: Why You Need Alternative Investments is a great way to get an overall view of alternative investments and why they are vastly superior to conventional investments. You can order the book here.

- Gift the book to young people in your life. They have a long investing runway ahead of them, and the sooner they choose the alternative path, the better off they will be.

- Leave a Google review. If you like the content here at TheProlificInvestor.net, Google reviews are one way I can grow my brand and help more people make better financial decisions. To leave a Google review, click here.

Great article, this shows why apartment syndicates are so popular. Nice analysis in showing the details.

Thank you Marc! It’s always fun to sit down and put some thought and analysis into these topics.

Nice easy explanation between the three real estate investment options. Really like how the Time Commitment, Risk Level, Minimum Investment, and ROI categories stack up in the Syndication column! As always, thanks for sharing this in writing.

Thanks Liz! Yes, interesting that you can invest less time, take less risk, and earn better returns.