In Blog #1, the answer to one of my rhetorical questions was “compound vs. simple interest.” Since I threw that out there without any explanation, and I’m embarrassed to tell you how many decades I walked this planet before I had a good understanding of this concept, I figure it merits some further explanation.

Compound interest is what you get in a savings account or other investment where the interest on your investment is added to your original principal, and the next time you get interest, that interest is on the sum of your principal and the accumulated interest.

Simple interest is what you pay on a car loan or mortgage where every payment includes an interest and a principal component. The interest piece goes to your bank, and the principal portion reduces your loan balance. Since each payment reduces your loan balance a bit, you pay less and less interest with each successive payment.

It’s one thing to describe the concept in words; it’s more dramatic, however, to see the differences when you look at the numbers. Let’s pretend you have a savings account earning 10% and a car loan with an interest rate of 10%.

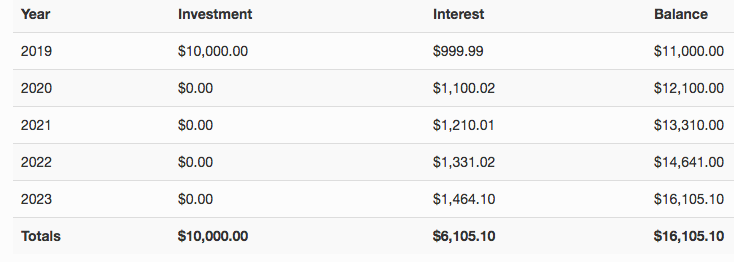

In the first graphic below, you’ve put $10,000 into a savings account and made no additional deposits. At the end of five years, you’ve earned $6,105.10 in interest.

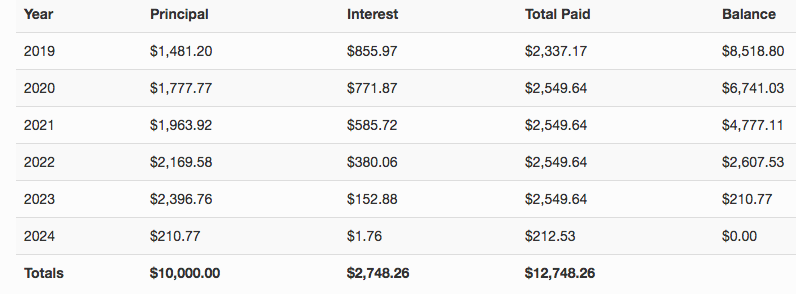

In the second graphic, you’ve got a $10,000 car loan with a 10% interest rate over five years. The graphic doesn’t show it, but your monthly payment is $212.47/month.

Wow, in both scenarios, the term is five years, and the interest rate is 10%. But with compound interest, you earn $6,105.10 in interest. With simple interest, you only pay $2,748.26 in interest. This is why you have to think carefully about whether making extra payments on a fixed-interest loan make sense.

Depending on the compound-interest rate you can earn on any money you might use to make additional principal payments, you may be better off riding out the loan for the full term and investing the extra money.

COMPOUND INTEREST SAVINGS ACCOUNT

SIMPLE INTEREST CAR LOAN

Another Easy to understand explanation of a difficult concept for most people. Love It!

Thank you Aaron! Appreciate the feedback. Chris

Congratulations Chris – good stuff. Will look forward to more blogs. I am very interested! Elisa

Thank you Elisa! Many more to come. Chris

I have enjoyed your first two blogs, Chris. After spending so much time with you, I know you have a lot more to share. Keep up the good work! ! !

BTW-I have been thinking about becoming debt free. You have given me something to think about.

Thank you Ray! Glad I could cause you to pause on the whole debt-free idea. Good, strategic debt is a wonderful thing. And eventually, we all run out of our own money to invest, so unless we want to sit on the sidelines, we’ve got to use debt to continue to invest and increase our net worth and cashflow. Chris

Like it Chris, please keep your blog going!

Thanks Ken! Next topic is coming, probably after the holidays.