Did you know that as a W-2 employee, you pay the highest taxes? Higher than businesses and investors? The reasons for this and the overall misunderstanding of the tax system played out in a recent Facebook discussion. Unbeknownst to me, a discussion was taking place on Facebook recently between some friends of mine about a news article naming ninety-one companies that paid no Federal taxes in 2018. A comment by one person was that he wished he could buy legislation whereby he could pay no Federal taxes. Another comment was that you had to have high-paid CPAs in order to avoid taxes. That’s when one friend tagged me and asked what I thought about all this. Naturally, I was very happy to jump in as taxes, particularly the legal avoidance of them, are one of my favorite subjects. My comments were something along these lines:

Thanks for including me in this conversation. Taxes are one of my favorite subjects and are very misunderstood by most people. The government uses tax laws to reward activity that stimulates the economy. If you want to pay less taxes, you just have to do the type of activity the tax laws reward. And, you don’t have to be rich or have a high-paid accountant to do this. The best tax moves I’ve made in my investing career came from me through my study of the tax law and from networking with other successful business people and investors.

If a person earns his income in the form of a W-2, he pays the highest taxes because he’s primarily a consumer and doesn’t stimulate the economy or create jobs like businesses and investors. Any W-2 person can have a business or be a professional investor. What’s needed is financial education, which is readily available in books, seminars, classes, and Podcasts. If you want to reduce your taxes, start by reading Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering your Taxes by Tom Wheelwright. Tom is often referred to as the smartest tax guy in the country.

One of the best ways to illustrate the difference between how the IRS taxes employees vs. businesses and investors is to look at when in the business cycle they are taxed and on what type of income. W-2 employees are taxed on their gross income first. The IRS gets a portion of your income before you do. If you’re a business or a properly structured investor, you pay taxes on your income after expenses and pay the IRS quarterly. You actually get the use of your money before the IRS.

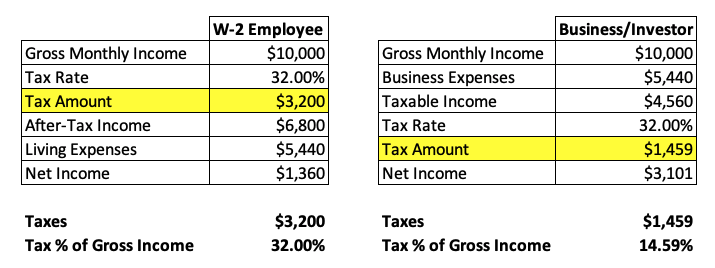

Let’s do the math. To simplify the example, I’ve made some assumptions.

Assumptions

- Gross Monthly Income – $10K

- Monthly Expenses – $5,400

- Income Tax Rate – 32%

The W-2 Employee

The W-2 employee has it the WORST! Before he even gets paid, the IRS has taken its share of taxes ($3,200) from his GROSS pay ($10K). Then the employee gets to pay his living expenses ($5,440) with the money that’s left over and maybe save a little ($1,360). In reality, employees do get limited deductions as defined by the IRS, but they in no way represent the same level of deductions that businesses get.

The Business/Investor

Businesses and investors have it MUCH better! They receive the same monthly income ($10K) but before paying taxes, they get to subtract their business expenses ($5,440). Only then do they get taxed ($1,459) on their after-expense income ($4,560). In reality, most businesses are taxed at a lower rate than employees.

The Bottom Line

- Employees pay taxes on their gross income.

- Businesses and investors pay taxes on their net income.

- The employee paid $3,200 in taxes.

- The business/investor paid $1,459 in taxes.

- The employee was taxed at 32% of his gross income.

- The business/investor was taxed at 14.59% of its gross income.

In summary, businesses and investors stimulate the economy by providing housing, jobs, and energy; and they get rewarded for doing what the government wants. Employees are primarily consumers and are heavily taxed.

As Tom Wheelwright says, “If you want to change your tax, change your facts.” If you’re an employee, you might make more money as an independent contractor. Ask your employer about changing your status. With your investments, invest as a business. Instead of investing in your personal name, John Smith; invest as John Smith, Inc. or John Smith, LLC. When you invest through a properly structured entity, your investment income gets the same tax treatment as a business. Start a part-time business. You don’t have to quit your day job, but to reduce taxes, your need to start shifting your income from the personal side to the business/investment side.

You’ll need professional advice on how to do this. Two resources I have used are Corporate Direct and Anderson Legal, Business & Tax Advisors. Also, I suggest your start listening to the Podcasts on the resources section of this site.

Image by Eric Perlin from Pixabay

This is a great example Chris! As I have been pounding my fricking head for the last 6 weekends getting all of my tax documents in order…including those K-1’s for the investments made from the SDIRA via Quest Trust….and I as I am re-training, yes re-training, if I had any at all before, on taxes…. I am becoming bluntly and painfully aware that I must prepare to move myself away from the W-2 (E&S) way of thinking towards the B&I way of thinking, and soon. In particular, immediate protection of my SDIRA investments which I now understand is a direct target of Congress through proposed new legislation to dive even further into our pockets above and beyond the UBIT and UDFI taxes. Bastards…..I need to figure the best path on how to transition from the W-2 life to the Business side of the tax game. Great Post!!

Regards,

Tom

Thanks Tom! Glad you’re working on it. With taxes and interest being the two biggest expenses most people have, it’s a really good investment of one’s time to get these two things under control. Keep pushing forward.