Introduction and Prerequisites

Today’s topic is Putting the Family Bank to Use. If you haven’t read Blog #19 – Reduce Your Household Budget by 34.5% With the Family Bank, you might want to review that first.

Family Bank Review

To proceed, I need to do a quick review of the family bank. The family bank is simply a savings or checking account that you set up to be your family bank or an existing bank account that you designate as your family bank. You then make deposits into your family bank until you have a balance large enough to make a significant purchase, like a car, for example. Then, instead of paying cash for a car or taking out a commercial bank loan, you take a loan from your family bank to purchase the car and begin paying yourself back with interest at terms similar to that of a commercial bank.

Why would you do this? Because it keeps one of your largest household expenses, interest, in your pocket.

But why wouldn’t I just pay cash, you ask? If you pay cash, the interest you don’t pay the bank likely won’t end up in your savings account or contributing towards an investment; you’ll simply spend it on something else. If you loan the money to yourself, the interest you would have found a way to pay the commercial bank will end up back in your pocket, build your family bank balance, and be available to fund the purchase of the next car, a new furnace, or a roof for your house.

In the following examples, I will show you how to use the family bank to purchase the family car, the family boat, and your child’s first car. These purchases will take place over fifteen years.

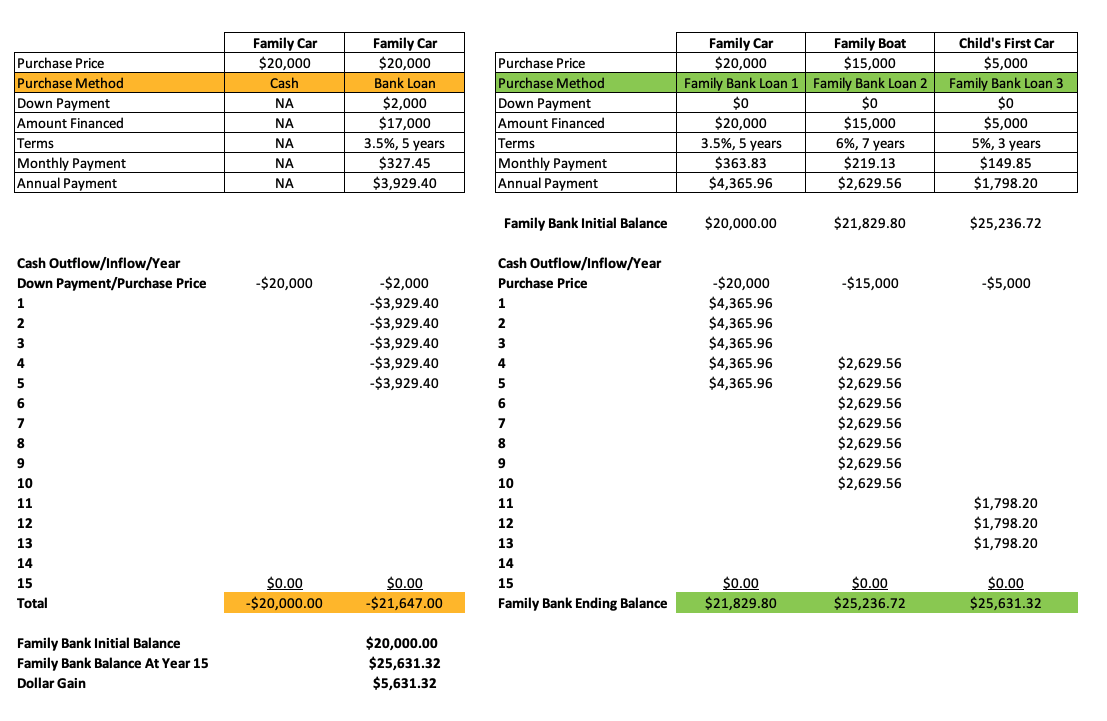

There are three ways to purchase each of these: cash, commercial bank loan, or a family bank loan. Let’s look at the math for all three.

$20K Car Purchase With Cash

Nothing complicated here. You simply exchanged your $20K for a car.

$20K Car Purchase With Bank Loan

Down payment: $2K (10%)

Interest rate: 3.5%

Term: 5 years

Monthly payment: $327.45

Annual Payment: $3,929.40

In this case, you pay the bank $3,929.40/year in payments for five years. The only difference is for the privilege of making payments over time; you paid $21,647 instead of $20K for the car.

$20K Car Purchase With Family Bank Loan 1

Down payment: $0

Interest rate: 3.5%

Term: 5 years

Monthly payment: $363.83

Annual Payment: $4,365.96

Instead of paying cash for the car or obtaining a commercial bank loan, you borrow the money from your family bank at the same terms offered by the commercial bank, except there is no down payment. Instead of paying the commercial bank $3,929.40/year, you pay $4,365.96 to yourself (higher interest due to 100% financing). At the end of the five-year term, you have the car just like before, but you also have $21,829.80 back in your family bank. YOU HAVE THE CAR AND THE CASH! But wait, IT GETS EVEN BETTER.

$15K Boat Purchase With Family Bank Loan 2

You’re in the fourth year of payments to your family bank for the car loan when you come across a $15K boat you’d like to purchase. HERE’S WHERE IT GETS EVEN BETTER; mid-way through year four of the car loan, you realize your family bank balance has grown to more than $15K, enough to finance the boat purchase. Here we go again.

Down payment: $0

Interest rate: 6%

Term: 7 years

Monthly Payment: $219.13

Annual Payment: $2,629.56

At the end of this loan, you own the boat in addition to the car, and your family bank balance has grown to $25,236.72, but wait, IT GETS EVEN BETTER.

$5K Car Purchase With Family Bank Loan 3

Just as you finish paying off the boat, your oldest child turns sixteen and needs a $5K starter car, and your family bank has a balance of $25,236.72. You can finance the car purchase yourself from the family bank, or you could have your child apply for a loan from your family bank. Either way, here we go again.

Down payment: $0

Interest rate: 5%

Term: 3 years

Monthly Payment: $149.85

Annual Payment: $1,798.20

When this loan is paid off, in addition to the initial car and the boat, you also own a second car and have $25,631.32 in your family bank. Remember, you started your family bank with $20K.

Putting It All Together

Over fifteen years, you did what most individuals and families do; you lived your life and purchased cars and boats for utility and enjoyment. Most people pay cash or obtain commercial bank loans for these purchases, which would cost them $40K if they paid cash, more if they borrowed the money.

By financing these with your family bank, you kept all that interest in your pocket and increased your family bank balance from $20,000 to $25,631.32. This may not seem like a lot of money, but it adds up over time. According to George Antone’s book, The Debt Millionaire, the average college-educated American will pay $525,00 in interest over her lifetime. With the family bank, you could keep some or all of that money for yourself and your family.

Maybe you don’t have $20K to start your family bank. It doesn’t matter, everyone starts where they are: $500, $1,000, $5,000, or $100/month. The bottom line is to get started.

START YOUR FAMILY BANK TODAY!

This is an interesting idea worth applying. It will help create and provide financing for various investments. Reminds me of another similar vehicle called Village banking.

A general comment that I didn’t put in the blog – as you pay off credit card and consumer debt (refinance it with your family bank), your credit score will go up as you’re using a smaller percentage of your available credit. So, we can add higher credit score to the benefits of the family bank.

Always nice to review and start with the basics. Thanks!

Thanks Liz! Amazing how something so simple and easy to implement can be so powerful.