Acquiring single-family rentals (SFRs) is one way many people invest in real estate. One strategy is to buy a property with a thirty-year, fixed-rate mortgage that will generate positive cash flow. In other words, the rent will cover all the property’s expenses (including the mortgage) and some reserves, and there will still be money left over to put in your pocket (positive cash flow).

Notice that unlike stocks and mutual funds, you’re not relying on appreciation for the property to be a successful investment. The property‘s value is likely to increase over the long term, but its value is irrelevant as long as you don’t need to sell it. The positive cash flow is what is carrying the property until you decide to sell.

I owned a rental condominium in the Seattle area during the 2007 – 2008 financial crisis, and the property’s value declined by fifty percent! But guess what? The property had positive cash flow, remained consistently rented, and I was able to increase the rent over time. Then, many years later, after its value recovered, I sold it for a profit.

But what if a property only breaks even from a cash flow perspective, never throwing off a single extra dollar in positive cash flow and never increasing in value? Highly unlikely, but is this SFR investment a failure?

Let’s set some ground rules and find out.

- SFR purchase price: $250K

- Down payment: $50K (20%)

- Mortgage amount: $200K

- Mortgage type: 30-year fixed, interest rate irrelevant

- Ownership length: 30 years

- Cash flow: Break even

- Appreciation: None

In this example, you’ll own this property for thirty years, the rent will cover all expenses (no positive cash flow), and the property’s value will not increase. While all this is highly unlikely, it makes for a good example. Note that I say the loan’s interest rate is irrelevant; that’s because the tenant pays all the principal and interest via rent. Is this investment a complete failure? Absolutely not! Let’s look at what will happen over the next 30 years.

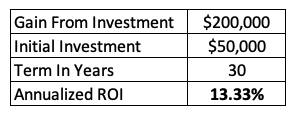

Over the next thirty years, your tenants will pay off the $200K mortgage. Your initial investment was the $50K down payment, and the value of your investment at the end of the thirty years is the free and clear house still valued at $250K. In other words, your $50K investment grew to $250K over thirty years by the mere fact that someone else paid off the $200K mortgage. With these numbers, we can calculate your annualized return on investment (ROI), 13.33%

Gain from investment divided by initial investment divided by investment term = 13.33%

Isn’t this fascinating? On the surface, an investment with no positive cash flow and no appreciation might appear to be a complete failure. But, actually, it’s damn good! The question you should be asking is; damn good compared to what?

According to Investopedia, the average annualized return of the S & P 500 from its inception in 1928 to December 31, 2021, was 11.82%. However, according to an article in The Balance, the average stock fund investor only earned 4.25%. Why is this? You can read the article for the gory details, but in short, investors are humans, and humans have emotions and make mistakes.

The choice here seems obvious to me; a tax-advantaged 13.33% annualized return from an SFR is better than a 4.25% annualized return from the stock market. And, with inflation running at 7.7%, the stock market investment lost 3.45% due to inflation (4.25% – 7.7% =-3.45%).

I saw a quote recently attributed to Chris Rock. It said, “Wealth is not about having a lot of money; it’s about having a lot of options.” If you want the option to do what you want, when you want, money is the only way I know to get there. So get out there and create more options for you and your family.

Help Me Break The Stranglehold Conventional Investing Wisdom Has On Most Investors

- Educate yourself; buy the book. Get off Your A$$ and Manage Your Money: Why You Need Alternative Investments is a great way to get an overall view of alternative investments and why they are vastly superior to conventional investments. You can order the book here.

- Gift the book to young people in your life. They have a long investing runway ahead of them, and the sooner they choose the alternative path, the better off they will be.

- Leave a Google review. If you like the content here at TheProlificInvestor.net, Google reviews are one way I can grow my brand and help more people make better financial decisions. To leave a Google review, click here.

Great article. The other key is playing the long game. Time is your greatest ally for realizing gains in an investment.

Thanks Jim! Agreed.