In 2017, I sold two rental properties in Washington State. They both had positive cash flow, but I felt I could do better by redeploying the equity in those properties elsewhere. The problem with selling investment real estate is you get hit with capital gains taxes. The only way I knew to defer the estimated $30,000 tax bill was to do a 1031 Exchange. In a 1031 Exchange, I would sell the two rental properties and buy a property or properties of equal or greater value, and no taxes would be due until I sold the new properties.

The problem was; I didn’t want to buy more Washington properties in the then-current seller’s market, and I didn’t want to buy something in another state that would be difficult and time consuming to remotely acquire and manage, especially while still working full time. As painful as it was, I had resigned myself to paying the $30,000 tax bill and moving on.

In December of 2017, I was contacted by an investor colleague who presented me with an opportunity to invest in automated teller machines (ATMs) using Section 179 of the IRS code. In Section 179, a taxpayer can deduct the entire cost of certain business equipment in the same year it is purchased instead of deducting or depreciating the purchase over time.

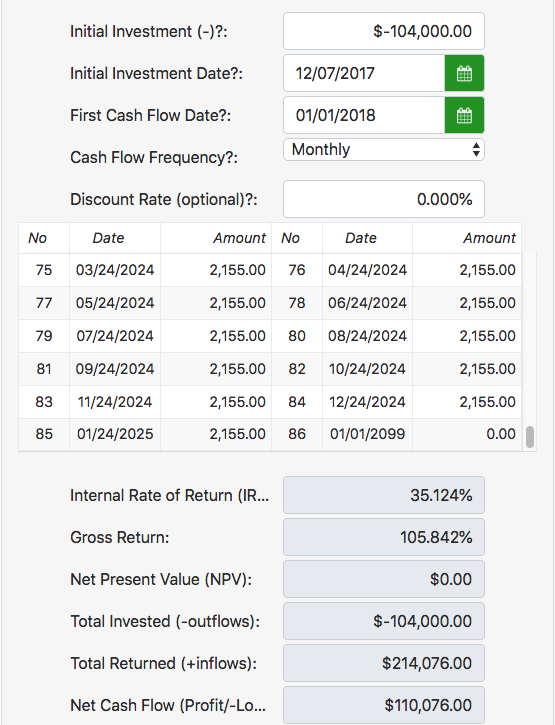

So, I purchased six ATMs for $104,000, and the entire purchase price was deducted as a business expense in 2017 and used to offset the capital gains from the sale of the two rental properties. Additionally, the ATMs pay me $2,155/month for seven years (84 months), and will then be sold at market value.

While this investment didn’t meet my normal investment criteria, I have exceptions; and one of them is when I’m trying to solve a tax problem. So, was this a good investment? Let’s look at the numbers.

When you use an internal rate of return (IRR) calculator and factor in the $30,000 tax bill I avoided (received a $3,056 refund instead) and the 84 monthly payments of $2,155, you get an IRR of 35.124%.

Not bad for just writing a check. And you should know, that I’ve never seen these ATMs and never will. They are completely managed by a third party.

Below is a screenshot of my my 2017 tax return showing the $104,000 business expense for the ATMs, and the IRR calculator results showing the 35.124% return.

Great strategy!

Thanks Liz! Yes, it worked out very well. Chris

Well done! ! !

Thanks Ray! It is one of my all-time, favorite stories. Chris

I love it!!

Dave, I’m not sure if I ever officially thanked you for that $30,000 phone call back in December 2017, so THANK YOU! For any of you that would like learn more about ATM investing or any of the other cool things Dave Zook is doing, check out his web site at https://www.therealassetinvestor.com/. Chris