Is it a good idea to pay off your home mortgage?

Of course it is! Everyone knows that. It’s the American dream, to own your home, be debt-free. Not so fast.

The answer is, it depends. If owning your home debt-free allows you to sleep at night and gives you great peace of mind, do it! Is it a good financial decision? If you have a long term, fixed-rate loan at a low interest rate, it’s not a good financial decision.

If I said to you, what would you rather have, a $100 bill today or a $100 bill 30 years from now, what would you say? You should say, I’ll take the $100 bill today because $100 today has more buying power than $100 30 years from now due to inflation.

Now, let’s look at the same scenario a bit differently. If I said to you, would you like to make a payment on your $250,000 home mortgage with a $100 bill today or a $100 bill 30 years from now. You should say, I’d like to make a payment with a $100 bill 30 years from now. The $250,000 you owe on your home is fixed. The dollars with which you are paying it off are declining in value every year.

Paying of your home mortgage with a low interest, fixed-rate loan over 30 years is a great hedge against inflation. You should take that deal every time!

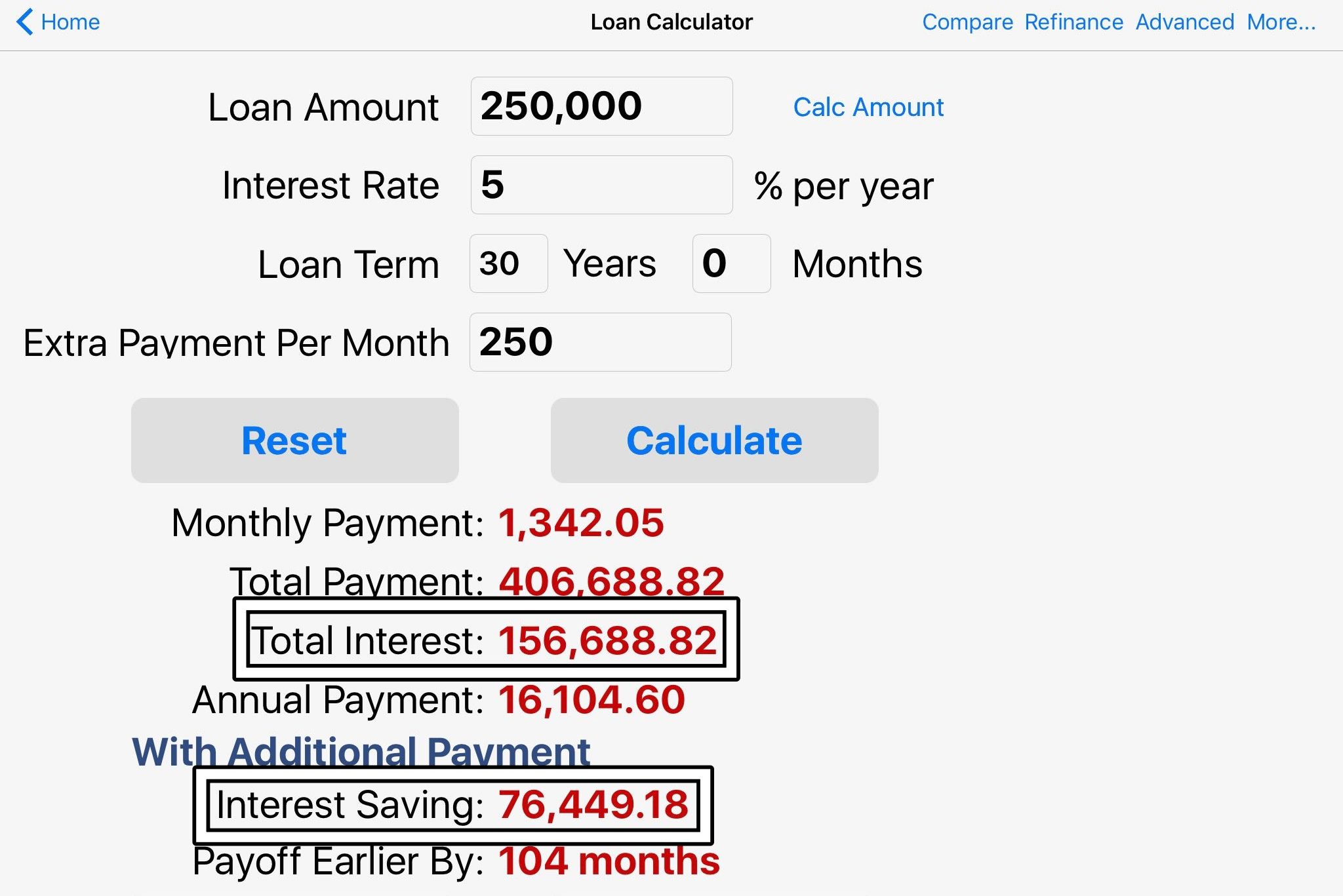

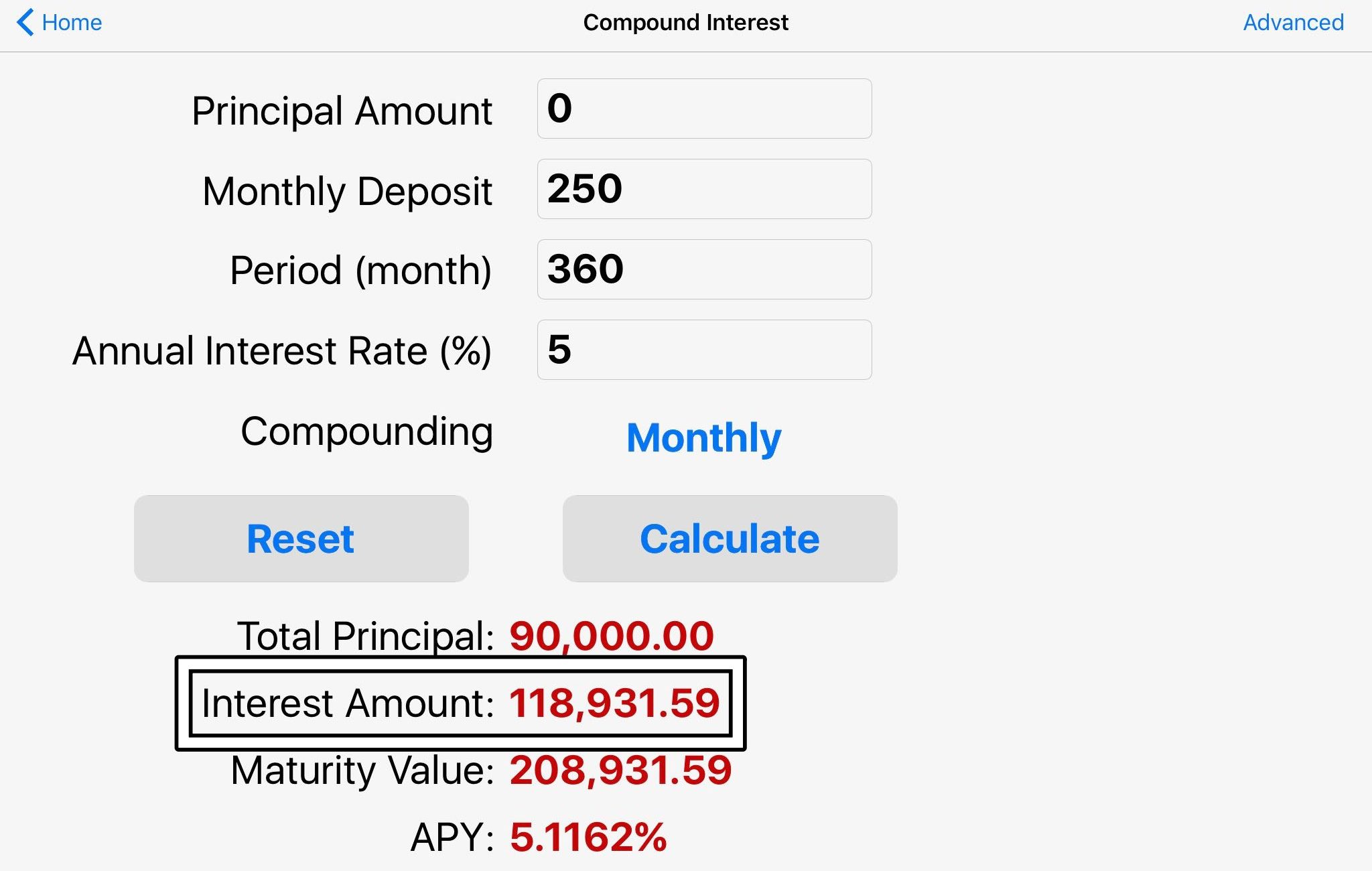

Let’s add a little more to the story. A $250K mortgage at 5% over 30 years will cost you $156,688.82 in interest. If you made an extra $250/month payment for 30 years, it would save you $76,449.18 in interest. Now, if you didn’t make that extra $250/month payment but instead put $250/month in an investment yielding a 5% annual return, you would earn $118,931.59 in interest, $42,482.41 more than the interest you’d save by making the extra principal payment. How is that possible? Your loan is simple interest, and your investment is compound interest.

Having said all that, all this changes as interest rates change, so you need to do the math. Additionally, there are some strategies where you can make the same mortgage payment but alter the timing and pay less interest. I haven’t tried this or done much homework on it, so I won’t comment more at this point.

Chris- great job on the blog~ I get asked this question all the time and it’s good to see it laid out in a way for people to understand. As you said, if it keeps you up at night, and you have the means, pay it off. Many retirees I work with choose to keep a small mortgage for many reasons. I just signed up for your blog fyi! 🙂

Hi Janelle. Thanks for your comment! Great to have some corroboration from a recognized leader in the mortgage industry. I find that home mortgages and HELOCS are the cheapest money around, so I like to take advantage of that. Another topic I want to tackle is whether it makes sense to use your home equity for investing purposes….

Chris

Hi Chris.

Where were you 10 years ago when I paid off my mortgage? I’ve enjoyed the conversations we’ve had over the last few years, but more excited for your new site/blog, and what I can learn.

Thank you Mark! I enjoyed those conversations as well. Where was I 10 years go? At the beginning of my Prolific-Investor journey, so I couldn’t have provided this opinion back then. Even so, knowing your more conservative nature, I’m sure that paid-off mortgage provided you with great comfort and peace of mind all those years.

Great example of an alternate way of making money work for you! I can’t wait to see a blog about using 401K funds to open up a self directed IRA and then invest that IRA into a REAL asset with infinite returns, all the while knowing that money is no longer at the mercy of the stock market. I am a fan…have been for a few years…..and will certainly miss the long conversations at lunch and other times, all the while looking at the faces of those sitting around the table with us and their “you’ve lost your mind” look on their faces…I can’t thank you enough Chris! I am into year two of this journey and am slowly increasing my financial IQ as well as retirement funds confidently. Looking forward to future posts on different subjects.

Yes, it is kind of the end of an era Tom. I will miss those lunchtime conversations as well. Thank you for listening to all my ideas and discoveries over the years! I’ve added your suggested topic to my list.

I was searching the internet for basic investor type information and came across The Prolific Investor, what a breath of fresh air (no sales pitch). Congratulations Chris on your first blog – keep them coming. I like the way you brought a real life example and calculation to blog #1 , it made it easy to follow your discussion. I am an instant follower, please continue to post more of your investment insight. Thanks

Thank you for the feedback Ken! I’ve got a long list of other topics coming so stay tuned.

Great information. Nice logical breakdown. I love the easy to understand images as examples. – AS

Thank you Aaron! The calculator screenshots were a last-minute addition. Glad you found them useful.