Today’s topic is Opportunity Cost. What is Opportunity Cost anyway?

Anytime you have a choice about how to spend, save, or invest money, there is an Opportunity Cost. Very simply, it’s the difference between the return you could have gotten on your money if you had chosen the best option and the return you GOT on your money based on the option you actually chose.

According to Investopedia, Opportunity Cost represents the benefits an individual, investor or business misses out on when choosing one alternative over another. The formula set forth in Investopedia is as follows:

Opportunity Cost = Return on best forgone option – Return on chosen option

While I didn’t use the term Opportunity Cost, I actually covered this topic in Blog #1 – Is It A Good Idea To Pay Off Your Home Mortgage? In that blog, I calculated the Opportunity Cost of making an extra $250/month principal payment on your home mortgage instead of taking that $250/month and investing it at 5%.

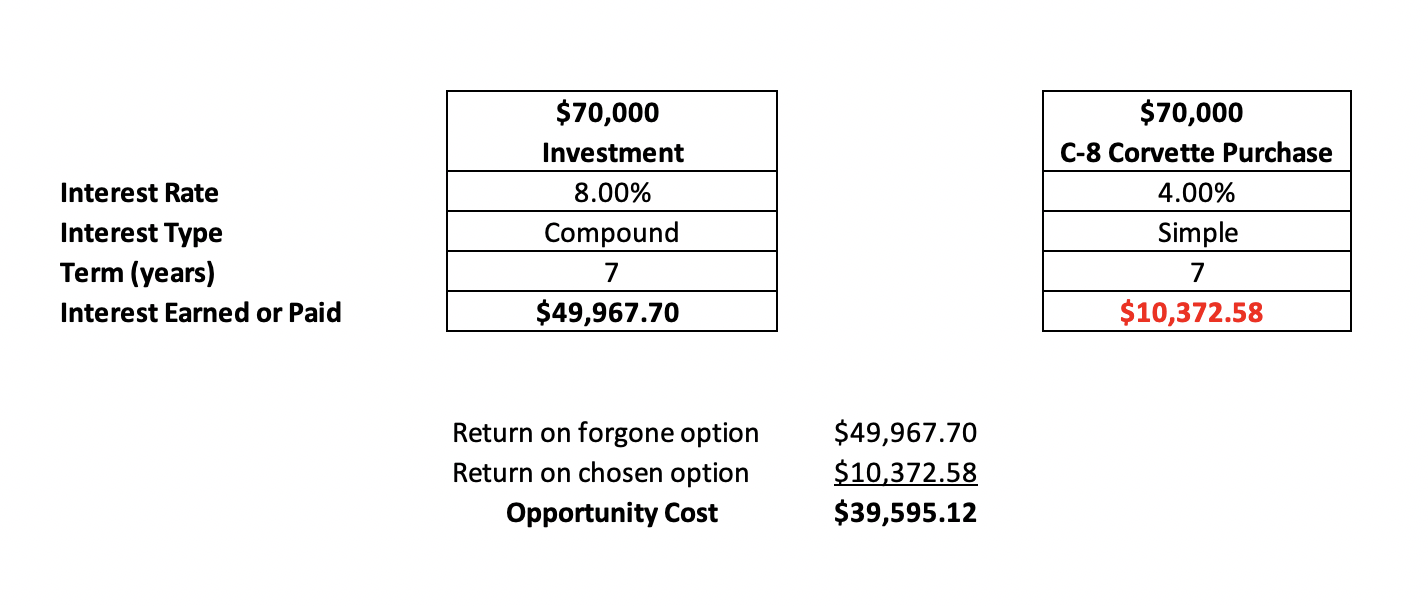

Let’s look at another example that we can all relate to; should I buy that new car with cash or get a car loan? Since I like Corvettes, let’s say you want to purchase a new, C-8, Mid-Engine Corvette for $70,000; and you’re fortunate enough to have $70,000 in the bank to make this purchase. But, is that the best use of your $70,000? By paying cash for the Corvette, you’ll save the $10,372.58 in interest that you would have paid on a seven-year loan at 4%.

But what if got the car loan and put the $70,000 into an investment that earned 8% over the same seven years? You would earn $49,967.70 in interest.

The bottom line is, if you paid cash, your Opportunity Cost was $39,595.12, the difference between the $49,967.70 in interest you could have earned less the $10,372.59 in interest you saved.

Whether you’re comparing different investments or making a buy/finance decision, one choice will always be a better use of your money, and the Opportunity Cost is what the wrong decision will cost you.

You had me at Corvette! Oh, and the numbers pan out, too! 🙂

Thanks for the double-check on the numbers Rod! It’s always good to lead with your strengths 🙂

Hi Chris,

I get it that your example is meant to be simple (it didn’t address that I would likely still have to make a down payment, so the bank wouldn’t have loaned me the full $70,000, which would bung up the numbers), but the concept is sound. But my question is, how likely is it that I would be able to find an investment for my money (less the down payment) that would make an 8% return (or at least a rate that would make it worthwhile)?

Hi Scott,

Good point! There would likely be a down payment on the car loan. I’ll endeavor to do better next time. As far as getting an 8% return, that’s very doable. If you review Blog #12, I lay out the numbers for a single-family (SFR) rental vs. a stock market investment via a 401K. The SFR numbers are very compelling, way above 8%. You can earn 10% at AHP Servicing with an investment as little as $100 https://ahpservicing.com/investors/. It looks like you can make 8% with Partners for Payment Relief https://pprnoteco.com/invest/note_funds/. I’m not sure what Colonial Funding Group is offering right now. You’d need to contact them, but it’s likely 8% or higher http://colonialfundinggroup.com/investor/. I have invested with all three of these companies and have been mostly satisfied with their results and customer service. AHP servicing is open to non-accredited investors. The other two require you to be accredited, https://www.investopedia.com/terms/a/accreditedinvestor.asp. Happy to discuss any of these with you if you like.

Good points.

Thanks John! I actually learned this lesson the hard way when I purchased a Corvette with cash before I was fluent in this topic. After the purchase, I found a lender that was willing to do a “car-equity loan,” and I was able to get the equity out of the Corvette and invest it.