Today’s topic is My Second-Favorite, Tax-Savings Story. My Favorite Tax-Savings Story was back in Blog #6. More on that later.

We’re all passionate about various things: luxury watches, motorcycles, investing, music, etc. Oh, wait, that’s me. You’ve got your list of things that drive you. Another passion of mine that I didn’t mention is the legal and ethical elimination of taxes. (Notice I said elimination, not reduction or postponement.) Actually, tax elimination is just an extension of my passion for investing. In business and investing, there are two ways to increase the bottom line: grow revenue or reduce expenses. Most people focus on increasing revenue or return but neglect one of their biggest expenses, TAXES! With conventional investing, to earn a bigger return, you have to take on more risk. And that risk might actually mean you make less of a return or even lose money; it happens all the time. In Blog #6 – My Favorite Tax-Savings Story, I avoided $30K in capital gains taxes not by taking on any additional risk but just by picking the right investment, one which would offset my capital gains.

With conventional investing, how do most people reduce taxes? In IRAs and 401Ks. I’ve come to believe; actually, I’ve come to KNOW through investing experience that putting money in IRAs and 401Ks is not the best way to reduce your taxes. In Blog #12 – What’s A Better Investment – A 401K Or A Single-Family Rental?, I show that the tax benefits associated with a single-family rental are vastly superior to those of a 401K.

With 401Ks and IRAs, you don’t eliminate taxes; you just postpone them. The theory is that you’ll be in a lower tax bracket in the future because you’ll have less income in retirement. In my mind, there are some things wrong with this approach:

- I don’t plan to be less successful in the future; I plan to make more money, even in retirement.

- Even if I am making less money in the future, taxes will likely be higher.

- Even if the IRS doesn’t change the tax brackets, inflation could push me into a higher bracket regardless.

Finally, on to My Second-Favorite, Tax-Savings Story – Because I know the tax savings are better outside of IRAs and 401Ks, I am carefully taking money out of my 401K as quickly as prudently possible, so I can gain the tax benefits associated with investing in real assets like ATMs, real estate, and energy. In 2019, I wanted to take a $100K distribution from my 401K. In the 32% bracket, that would cost me $32K in taxes! My challenge was to figure out how I could take the distribution and pay no taxes.

Because of my continuing education and network, I know there are very few ways to offset Ordinary Income, which is how IRA and 401K distributions are characterized.

One way to offset Ordinary Income, however, is by making an energy investment within the scope of IRS Code 469. So, in 2019, made a $100K investment in coal distillation units, which turn coal into chemical byproducts used in the manufacture of cosmetics and pharmaceuticals. This investment entirely offset the $100K distribution from my 401K, saving me $32K in taxes!

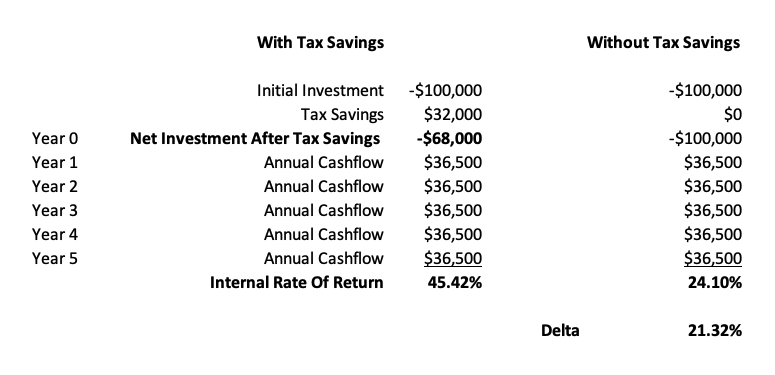

Let’s look at the Internal Rate of Return (IRR) of this investment.

- Initial Investment: $100K

- Tax Savings: $32K

- Cashflow: $9,125/quarter; $36,500/year

- Term: 5 years

- IRR: 45.42% (With Tax Savings)

- IRR: 24.10% (Without Tax Savings)

- Delta IRR: 21.32%

As you can see, with the tax savings, this investment produces a WHOPPING 45.42% IRR! The tax savings alone added 21.32% to the return. Most conventional investors will never see even a 21.32% return, much less 45.42%.

The bottom line here is that reducing or eliminating taxes might just be the easiest, best, and safest way to increase the performance of your investments. Remember, it’s not what you make that matters; it’s what you get to keep, so get serious about reducing or eliminating taxes!

If you’d like to know more about this investment as well as the ATM investment from Blog # 6, contact my friend Dave Zook at The Real Asset Investor.

Other related resources include:

- Tom Wheelwright’s book Tax-Free Wealth and his Wealthability Podcast.

- Buck Joffrey’s WealthFormula Podcast.

- Andy Tanner’s book 401(k)aos: How Our Dream of Retirement Became a Nightmare of Chaos

As always, when you make better financial decisions, someday you can make work a choice instead of a necessity.

So much for the 4% draw down rule. You’ll never spend it all.

I’m all for anyone using the tax laws to their advantage, well done!

Thanks for the comment Mark!

As you know, I’m not a big fan of the “Mountain of Money” retirement theory, which is where the 4% rule comes in. I prefer to acquire cashflow-producing assets, so I’m not selling off my portfolio to live. My position on the “Mountain of Money” retirement theory (my term) was solidified when someone showed me the “Sequence of Returns Risk,” https://www.investopedia.com/terms/s/sequence-risk.asp. This risk is that you start drawing down on your mountain of money at a 4% rate in a down market and are selling off shares at lower prices. In this scenario, one could run out of money before they run out of life.

Regarding taxes, here’s a quote I like, “Anyone may so arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which will pay the Treasury. There is not even a patriotic duty to increase one’s taxes.” Judge Learned Hand https://en.wikipedia.org/wiki/Learned_Hand