You wouldn’t think of storing money under your mattress, would you? Of course not! But, many of you do something equivalent without even knowing it. But before I dive into that, what’s wrong with storing money under your mattress anyway?

-

- First, your money isn’t working for you; it’s not growing, not earning any interest.

- Second, since it’s not growing, and we have this thing called inflation, your money isn’t even maintaining its buying power. So, in other words, you’re losing money.

It’s why we have banks where we used to earn a reasonable rate of interest on our money. And you intuitively know that you’re supposed to earn interest on your idle money. It’s why we complain about the fact that we can’t make a decent interest rate at the bank or with money market funds, bonds, or CDs.

While we complain about this, many of you have tens of thousands or even hundreds of thousands of dollars sitting around losing money to inflation, aka stored under your mattress. It’s in the form of home equity. I know what you’re going to say; the value of my home is growing! While that may be true, the value of your home is growing regardless of whether you have a mortgage.

Before I go any further, I have to discuss whether or not your home is an asset, an investment. The answer is, it depends. A home is typically the biggest purchase most people make, and if you put it on a personal balance sheet, you’d likely put it in the asset column, and I certainly wouldn’t argue with that. Robert Kiyosaki has a straightforward and precise definition of assets and liabilities. An asset is something that puts money in your pocket, and a liability is something that takes money out of your pocket.

Using that definition, a cash-flowing single-family rental is an asset as it puts money in your bank account every month. However, your primary residence is not because it takes a lot of money out of your bank account every month in the form of principal and interest payments, insurance, taxes, and maintenance. If you lose your job, what is your biggest worry; it is making the payments on your biggest liability, your primary residence. My purpose here isn’t to persuade anyone as to whether their home is an asset or liability. Still, many people think of their home as an investment, so let’s treat it that way to determine whether your equity is working for you.

With investment real estate, one way to measure performance is return on equity (ROE). Unlike conventional investments, alternatives such as real estate are usually purchased with the help of loans or leverage. Since the loan isn’t our money, we need to measure how much money the asset is making on our equity, the down payment.

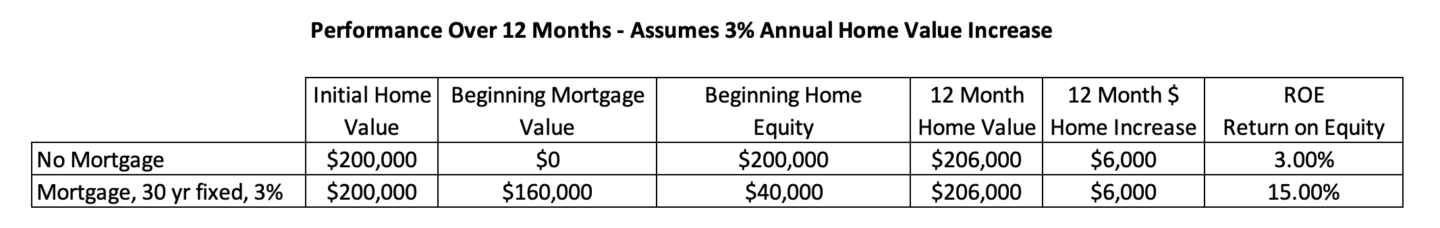

Let’s look at the ROE on a primary residence with and without a mortgage at the end of one year.

In the first example, we buy a $200K home with cash. At the end of twelve months, the house went up in value by three percent, $6K. When we take the $6K and divide it by our equity, our initial investment of $200K, we get a three percent return on our equity. I don’t know about you, but I don’t very excited about investing $200K and only getting a three percent return. Of course, there are other benefits, like having a place to live, raising your children, etc.

In the next example, we buy the same house with a mortgage and put down $40K, twenty percent. At the end of twelve months, the house went up in value by three percent, $6K. When we take the $6K and divide it by our equity, our initial investment of $40K, we get a fifteen percent return. Ok, I’m getting a little more interested in investing $200K if I can get a fifteen percent return. The key point here is; the less money you have in the deal, your down payment, the higher your ROE.

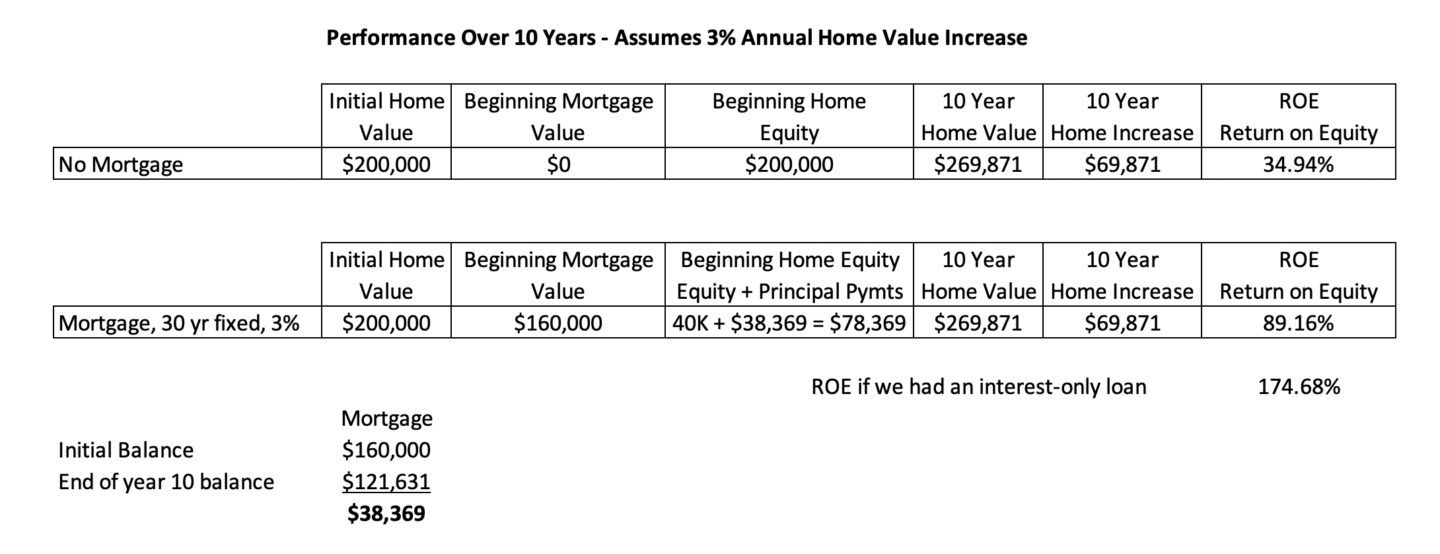

In the following two examples, we’ll look at the same house, with and without a mortgage, but at the end of ten years instead of at the end of one year.

In the first example, we buy a $200K home with cash. At the end of ten years, the house went up by three percent annually, $69,871. When we take the $69,871 and divide it by our equity, our initial investment of $200K, we get a 34.94 percent ROE.

In the next example, we buy the same house with a mortgage and put down $40K, twenty percent. At the end of ten years, the house went up in value three percent annually, $69,871. Since we’ve been paying the mortgage for ten years, we’ve reduced loan principal by $38,369 and have to take this into consideration. This is money we put into the deal over time, so we have to add this $38,369 to the $40,000 down payment to calculate our total equity of $78,369. When we take the $69,871 and divide it by our current equity of $78,369, we get an 89.16 percent ROE.

Once again, having a mortgage, less money in the deal increased our ROE from 34.94 percent to 89.16 percent. If we had an interest-only mortgage in this example and didn’t have to add the principal payments to our down payment, the ROE would have been 174.68 percent. The key point again is; the less money you have in the deal, the higher your ROE.

In all the examples, using debt increased the ROE. To put it another way, having a lot of equity in your home is not a good financial idea. That home equity is lazy money. It could be put to work earning a higher return for you somewhere else and accelerating your wealth accumulation.

The only party that benefits from larger home equity is the bank! More equity makes their loan to you less risky because the equity is a kind of cushion for them. If you can’t make your mortgage payments, the bank’s recourse is to sell your house and take the proceeds from the sale to recover the outstanding loan balance and costs. What if the sale proceeds aren’t enough to make the bank whole? Then, they dip into your home equity to make up the difference until they don’t lose a dime! Thank goodness you left all that money under your mattress, aka home equity, losing money to inflation just to protect the bank.

So you know that I practice what I preach, let me tell you some ways I have accessed and used home equity:

-

- Home Equity Line of Credit (HELOC) – I borrowed $100K from a HELOC to purchase an ownership share in a self-storage facility in Florida. I didn’t have the $100K at the time, but I did have the money to make the interest-only loan payments for several years until I could pay off the loan. This short-term borrowing strategy allowed me to get into a deal that I otherwise would have missed.

- Cash-Out Refinance – I refinanced my primary residence, took out as much equity as possible, and invested that money in multifamily real estate that produced much higher returns. Yes, this increased my payment, but I fixed that with the next step, an interest-only mortgage.

- Interest-Only Mortgage – I feel so strongly about having my money work for me that I don’t care if I ever own a primary residence free and clear. To me, a mortgage payment is just like paying electricity; it’s a housing expense. So I focus on keeping my monthly housing expense low by using fixed, thirty-year debt and putting the excess money to use in investments that earn me way more than the interest I’m paying on the thirty-year loan. And, if I can get an interest-only mortgage, I’ll take it every time. This gives me the lowest monthly payment in tough times. In good times, I can always put money towards the principal if I want to.

Remember, the amount of wealth you accumulate is determined by several factors:

-

- The amount of money you invest

- The return you earn on that money (ROE in these examples)

- The length of time your money is invested

- The amount of taxes you pay

We’ve just seen by the examples above why alternative investors accumulate wealth so much faster than conventional investors; by using good debt, they supercharge the return on their money, in this case, the return on their equity.

My very first blog was titled, Is it a Good Idea to Pay off Your Home Mortgage. I want to repeat what I said in that article because I still stand by it today.

If owning your home debt-free allows you to sleep at night and gives you great peace of mind, do it! Is it a good financial decision? If you have a long-term, fixed-rate loan at a low-interest rate, it’s not a good financial decision.

If you haven’t read the blog mentioned above, my example is different than the one presented here. I show you the results of making an extra $250 per month principal payment over thirty years versus simply investing that $250 elsewhere. The results are eye-opening!

So, what does this mean for you? If you want to accelerate your wealth accumulation, and you’ve got equity in your home, start thinking about the concepts discussed above. Increase your financial education until you get to a point where you might consider putting some of your home equity to use.

WARNING, THIS IS NOT A MOVE FOR THE BEGINNING OR UNSOPHISTICATED INVESTOR. SEEK PROFESSIONAL GUIDANCE BEFORE DOING THIS. IF YOU MAKE A BAD INVESTMENT WITH YOUR HOME EQUITY, YOU COULD LOSE YOUR HOME.

Help Me Break The Stranglehold Conventional Investing Wisdom Has On Most Investors

- Educate yourself, buy the book. Get off Your A$$ and Manage Your Money: Why You Need Alternative Investments, is a great way to get an overall view of alternative investments and why they are vastly superior to conventional investments. You can order the book here.

- Gift the book to young people in your life. They have a long investing runway ahead of them, and the sooner they choose the alternative path, the better off they will be.

- Leave a Google review. If you like the content here at TheProlificInvestor.net, Google reviews are one way I can grow my brand and help more people make better financial decisions. To leave a Google review, click here.