I was recently asked to be a guest on a podcast and provide some retirement and investing advice. While I’m not a financial planner and can’t give such advice, the request caused me to look back at my history and identify seven tactics that I used successfully to achieve financial independence.

I’m a big fan of learning from the successes and failures of other people. The problem with me giving you my wealth-building tactics is that this is personal finance. It’s personal, and what worked for me might not be right for you, your situation, or your skillset. As I was retroactively identifying my seven tactics, I thought, aren’t there some universal wealth-building principles? Principles that aren’t unique to me and would help determine if the tactics you choose align with these universal truths? I believe there are.

While I didn’t consult books or so-called experts when I came up with these principles, if you asked a group of successful investors, I believe there would be general agreement around these four principles. Additionally, it’s one thing to tell someone how to achieve something. It’s something else to tell someone why they should do something. People are more likely to take action if you tell them why that action is expected to work. My seven wealth-building tactics are the how, and the four wealth-building principles are the why.

Wealth-Building Principles

1. The Amount of Money You Invest

The amount of wealth you accumulate and the speed at which you do so depends on how much you invest over time. A person who can invest $100K per year will accumulate wealth faster than someone who can only invest $10K per year.

2. The Return You Receive on the Money You Invest (ROI)

The amount of wealth you accumulate and the speed at which you do so depends on the return you receive on the money you invest. If the average annual return on your investments is between 20% and 30%, you will accumulate wealth faster than someone whose average annual return is between 8% and 12%.

3. The Taxes You Pay on the Money You Earn

The amount of wealth you accumulate and the speed at which you do so depends on how much taxes you pay on the money that comes from your investments, how big a piece the government takes. If the money you receive from your investments comes in the form of ordinary or investment income, you will pay more taxes than if it comes in the form of passive income, where you can pay little to no income taxes. See Blogs #39, #29, and #28 for my best tax-savings stories.

4. The Velocity at which You Recycle Your Money

This principle has to do with how quickly you get your money back from one investment and deploy it into the next one. The best way to explain this is by example. When I make a $100K investment in an apartment syndication, I will receive my $100K back within about three years. The impressive part is that I will still own the percentage of the building that my original $100K investment represented and continue to receive cash flow from that investment until we sell the building. This is accomplished by refinancing the building as its value increases, primarily due to our improvements to it and the corresponding rent increases. With that original $100K now back in my hands, I can invest it somewhere else while I still own my portion of the apartment building. My original $100K is now making money for me in two places at the same time. Blog #9 – Infinite Returns and the associated video describe how this principle works in more detail. Now that we’ve gotten the principles out of the way, let’s move on to the wealth-building tactics.

Wealth-Building Tactics

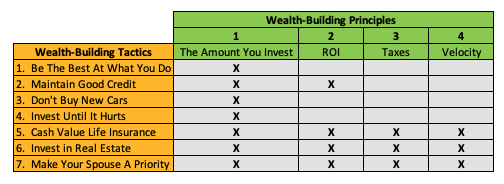

As I go through the wealth-building tactics, I will relate them to one or more wealth-building principles. You can see this represented visually in the figure below.

1. Become the Best at What You Do

The only money you have to invest is the amount exceeding your living expenses. If you make $63K per year, and your living expenses are $63K per year, you have no extra money to invest. The solutions are to increase your income or reduce your expenses. For this example, let’s assume you run a tight financial ship, and there’s no way to reduce your expenses any further; that leaves increasing your income. To get regular promotions and pay raises, you need to be the best at what you do. You need to continue to improve your knowledge, skill, and experience, so you are more valuable to your employer and will be the one that gets the promotions and the raises. This will raise your income above your expense load of $63K and allow you to begin investing for financial freedom or retirement. Also, you could start a side hustle to supplement your employment income.

This tactic relates to principle number one, the amount of money you invest

2. Maintain a Good Credit Score

Maintaining a good credit score does several things for you. First, it allows you to get all kinds of loans: real estate loans, personal lines of credit, and HELOCs. A good credit score also reduces the amount of interest you will pay on these loans, as well as the amount you pay for insurance.

This tactic relates to principle number one. With good credit, instead of just relying on your excess income to make investments, you can borrow money to make investments (alternative investments only as banks don’t typically loan money to buy conventional investments).

It also relates to principle number two, the return you get on your money because using leverage or borrowed money increases your ROI.

3. Don’t Buy New Cars

Numerous people have asked me how I put two kids through college on mostly a modest, single income. While multiple factors allowed me to do this, one thing that was the most impactful was that I didn’t buy new cars when my children were growing up.

I did a rough calculation one time to determine the amount of money I saved over eighteen years by not purchasing two new cars every three to five years. Amazingly, that amount was enough to put two children through college.

This tactic relates to principle number one because the money you save by not buying new cars is more money that can be invested.

4. Invest Until it Hurts (Macro-Budgeting)

I’ve never been good at tracking every penny I spend, what I call micro-budgeting, so I budget at a macro-level. Invest as much as you can until you’re a little uncomfortable and spend the rest on whatever you like.

This tactic relates to principle number one because the regular practice of setting aside a specific amount of money for investment will increase the amount of money you invest over time.

5. Make Cash Value Life Insurance the Foundation of Your Investments

I believe cash value life insurance should be the foundation of every serious investor’s portfolio. This complicated topic is beyond the scope of this article, so see Blog #36 and #37 for more details. A properly structured cash value life insurance policy will supercharge your investments.

This is a SUPER-tactic because it relates to all four wealth-building principles – The Amount You Invest, ROI, Taxes, and Velocity.

6. Invest in Real Estate

Real estate is simply the best, long-term, high-performing, stable investment there is. This single asset provides numerous benefits: appreciation, cash flow, a built-in tax advantage, the ability to use leverage, and there is no technology on the horizon to make it obsolete.

This is a SUPER-tactic because it relates to all four wealth-building principles – The Amount You Invest, ROI, Taxes, and Velocity.

7. Make Your Partner/Spouse a Priority

Not making your spouse or partner a priority will end in divorce or breakup and is probably the single biggest thing that will derail your path to retirement or financial freedom. So, while I confess that I failed at this step, I feel I must include it anyway as I don’t think it’s any great revelation that getting this one thing right will make your path to financial freedom much easier and may even mean the difference between success and failure.

This is a SUPER-tactic because it relates to all four wealth-building principles – The Amount You Invest, ROI, Taxes, and Velocity.

In conclusion, there are many ways to get to financial independence or retirement, and each of us needs to find the path that works best for us. But rest assured, it will not happen by accident; it needs to be a focus in your life. Like any other significant thing you’ve ever accomplished, it will require time, study, and effort.

While I’ve shared the seven tactics that worked for me, the more important part is the four wealth-building principles. So, whatever tactics you choose, make sure they align with one or more of these principles. And, the more SUPER-tactics you can employ, the better off you’ll be.

Special thanks to Rod Zabriskie and Christian Allen of Money Insights, who helped me work through these concepts live on their Money Insights Podcast Episode 27 – The Prolific Investor’s Financial Independence Matrix.

Help Me Break The Stranglehold Conventional Investing Wisdom Has On Most Investors

- Educate yourself, buy the book. Get off Your A$$ and Manage Your Money: Why You Need Alternative Investments, is a great way to get an overall view of alternative investments and why they are vastly superior to conventional investments. You can order the book here.

- Gift the book to young people in your life. They have a long investing runway ahead of them, and the sooner they choose the alternative path, the better off they will be.

- Leave a Google review. If you like the content here at TheProlificInvestor.net, Google reviews are one way I can grow my brand and help more people make better financial decisions. To leave a Google review, click here.